What does the low cash rate mean for the Australian economy?

- Real Finance

- Apr 9, 2021

- 3 min read

Updated: May 25, 2022

On Tuesday, the Reserve Bank of Australia (RBA) announced that it will keep the Australian cash rate at 10-basis points for the sixth month in a row. In each meeting for the last 12 months the RBA cash rate has drastically decreased as a means of improving the Australian economy following the pandemic-led recession. The decision to leave this rate low has proven significant to improving the overall Australian property market.

From record-low interest rates, increasing house prices, and an improving unemployment rate - we'll explain how this decision improving the economic outlook for Australia.

The RBA announcement

In their recent statement, the RBA announced that the economic outlook in Australia has been improving and is better than expected. They predict that this recovery is expected to continue throughout the next two years as households and business balance sheets are healthy. This in large is due to the 3-Year Government Bond Yield Target of 10 basis points, where the Government plans to purchase bonds in order to maintain the 10-basis points. They also state that they're prepared to undertake further bond purchases if it will assist with the progress towards the ultimate goal of ensuring full employment and inflation across the nation.

An improving unemployment rate

In the RBA Cash Rate announcement, it was announced that the national unemployment rate is steadily improving. Unemployment decreased to 5.8 per cent during February. This is a promising figure as it means that the number of people who have a job has returned to what it was before the pandemic. Furthermore, the longer that the RBA Cash Rate remains at it's current low, the more unemployment will decrease within the coming months.

Low mortgage rates

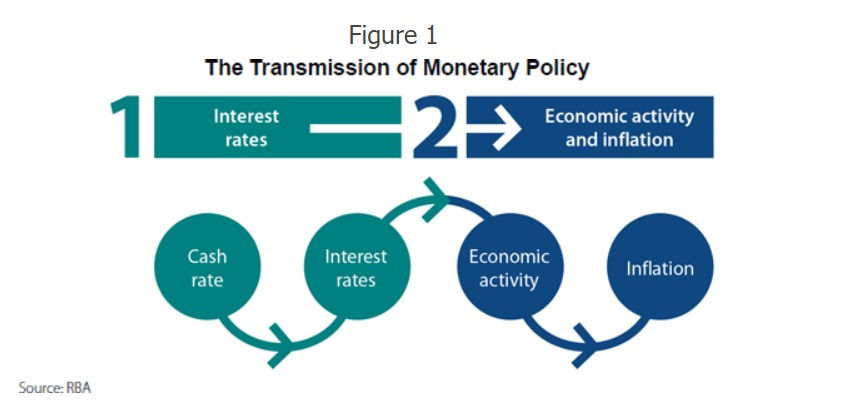

In monetary policy, when a cash-rate is low (like it currently is) it supports the banks in lowering their interest rates. This supports economic spending in households, which further leads to inflation. Inflation is the increase of value to money. Refer to the diagram below from the RBA, which outlines this process.

For the last six months, leading banks have followed in the pursuit of improving the Australian economy. Since the massive slash to the RBA Cash Rate in November, interest rates have drastically decreased. This can help assist banks in supporting consumers who wish to acquire assets such as property. Thus, making it easier for Aussies to make financial commitments such as taking out a mortgage. Which then leads to the rising value of assets. This is especially prevalent now with the increasing value of housing markets....

Significant increases to Australian property values

Australian housing markets have strengthened in recent months with prices rising in all markets. Whilst contributable to various factors such as Government stimulus measures like the recent HomeBuilder program, the biggest contributor has been the record-low interest rates. This has supported many Australians to take out mortgages with many of them being owner-occupiers and first home buyers.

Over the last three months housing markets have increased in value with March seeing the biggest month-on-month increase in over 32 years. The CoreLogic monthly home value index rose by 2.8 per cent brining the median value of residential dwellings to $614,768. At this rate, the housing market is on its way to reaching its predicted total increase of 17% for the year.

To learn more about what is boosting the value of the Australian housing market, check out our most recent blog article: Why Residential Property Prices Are Increasing.

Reach out

If you currently own property, it may be worthwhile reviewing the equity you currently hold. With the increasing value of Australian properties, you may have enough equity in your home to leverage off from and build a property portfolio. For a FREE, no-obligation consultation with our finance specialists, please reach out to our team on the details provided below:

Ph: 1300 130 932

Email: clientservices@reif.com.au

Comments